The 2019-2020 wire and cable industry profit level change trend and analysis of the reasons for the change

The 2019-2020 wire and cable industry profit level change trend and analysis of the reasons for the change

There are more than 4,000 wire and cable companies in my country, but more than 40% of them have experienced bad competition such as winning bids below cost and maliciously lowering prices from peers, and they hate it. Low-price bidding seems to have become a common unspoken rule of China's wire and cable bidding. Whether it is large wire and cable companies or small wire and cable companies, they are competing to lower prices in order to successfully obtain orders. And the magnitude of the price reduction is ashamed, and some are more than double the price.

Low-price competition becomes the norm

The rising cost of raw materials has caused many wire and cable manufacturers to face a serious threat of reluctance to maintain and close down. It is reported that China's raw materials, especially copper and aluminum materials, account for about 80% of the total cost of wire and cable production. In well-known companies in Europe, the United States and Japan, they have effectively reduced the proportion of raw materials in the total cost of wire and cable production through independent technological innovation and active research and development of new materials. European raw materials only account for about 60% of the total production cost, while the United States accounts for 69%, and Japan accounts for 73%, which is far lower than China's 80%. As labor costs increase day by day, as a result, the production costs of Chinese wire and cable manufacturers will inevitably be higher than those in Europe, the United States, and Japan, and the final profit will be much lower than that of companies in these countries.

China's wire and cable industry has overcapacity and low profit margins, and cable manufacturers have difficulties in operating the industry. This voice is often seen in various newspapers and magazines or online media, but in fact, this problem needs to be subdivided. If you simply say that the cable industry has low profit margins It’s not right. This is because it only knows one, not the other. Not all cable companies or cable products really have overcapacity and low profit margins. There are also cable companies with a gross profit of 25% or more.

01 Trends and reasons for changes in industry profit levels

1. The trend of changes in industry profit levels

There are many types of wire and cable products, and the profitability level of each market segment is different. Generally speaking, the total profit of my country's wire and cable industry has maintained a good upward momentum, but due to the large differences in the bargaining power and market competition of different companies, their profitability varies. Companies with strong technology research and development capabilities, high management levels, better cost control, product quality and brand recognition continue to win more market shares in the fierce competition, and their profit levels continue to increase; while smaller scales, technical Companies with lower levels and poor management are forced to withdraw from the market.

2. Reasons for changes in industry profit levels

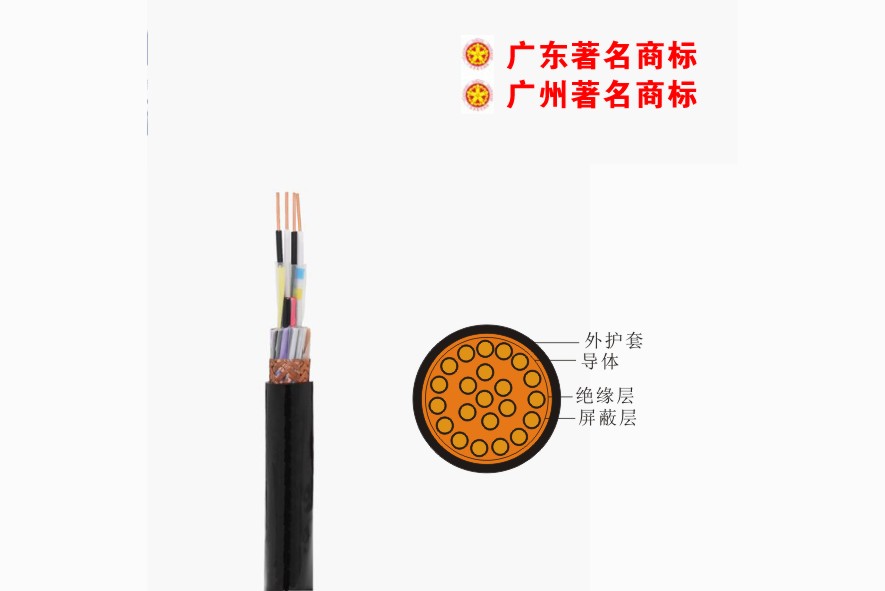

Wire and cable is a “material, heavy, and light” industry, and raw materials account for more than 80% of the total cost of wires and cables.

Therefore, although the concentration of the wire and cable industry has increased in recent years and the overall gross profit margin of the industry has gradually stabilized, changes in the prices of major raw materials such as copper and aluminum are important factors affecting the profitability of the wire and cable industry. The prices of upstream raw materials represented by the industry change frequently, so the profit level of the industry fluctuates significantly within a certain range.

02 Fluctuations in copper prices are the main barriers to entry into the industry

1. Qualification barriers

First of all, the state implements a strict production license system for the production of wire and cable products. The wire and cable products in the product catalog that are engaged in compulsory product certification must obtain CCC certification from the China Quality Certification Center. Some large downstream industries have also put forward corresponding industry access standards for cable suppliers, and entering different industries or products for different purposes also need to obtain the qualifications and certifications required by the industry.

Secondly, a large number of electronic products and electrical equipment of our country are exported abroad. In the international market, with the EU’s implementation of the "Restriction of Hazardous Substances" (Restriction of Hazardous Substances) on July 1, 2006, the United States, Japan, and EU countries have all imposed restrictions on imports. The product puts forward strict access certification standards.

Therefore, obtaining national production licenses and compulsory certifications, qualification certifications required by various industries and countries where each target market is located has become one of the most important obstacles to entering this industry.

2. Capital barriers

The wire and cable industry is a capital-intensive industry, which is embodied in the following aspects:

(1) The investment in the production line is relatively large;

(2) The wire and cable industry has the characteristics of "materials, heavy, and light". The main raw materials represented by copper have high value and obvious price fluctuations, which require a lot of capital;

(3) The general quality guarantee deposit system in the cable industry requires suppliers to have sufficient working capital to ensure the continuity and sustainability of production and sales;

(4) Increasingly fierce competition and continuously subdivided markets have prompted wire and cable companies to continuously increase the research and development of new products and new technologies. Companies that cannot afford the corresponding R&D expenses will be eliminated by the market in technological competition and brand competition.

3. Brand barriers

Compared with the general equipment manufacturing industry, the wire and cable manufacturing industry is an industry with higher requirements for safety, reliability and durability. Among them, the requirements of customers in the high-end home appliance wiring assembly and special equipment cable market are the highest. These customers need suppliers to have strong supporting and R&D capabilities, and better production and testing equipment levels. Therefore, they pay more attention to the supplier’s brand reputation in the industry when introducing and selecting suppliers. Once a cooperative relationship is established, no It will easily introduce suppliers with poor reputation due to slight price differences and other factors, and will not easily change products that are already in use and have stable and reliable quality. It is difficult for new entrants to have advantages in terms of qualification certificates, quality assurance, supply capabilities and after-sales service.

4. Technical barriers

The production of wire and cable is mainly composed of multiple processes such as drawing, twisting, squeezing, and forming. Wire and cable production, especially the production of high-end home appliance wiring components and special equipment cable products, involves a series of processing technology such as formula improvement and innovation of polymer materials, metal smelting and calendering, optimized design of product structure, and composite shielding. In addition, the equipment, technology and management of wire and cable production vary greatly depending on the product. Special equipment cable products that have special requirements for product reliability, heat and wear resistance, and safety, non-toxicity, and environmental protection. The requirements for wire and cable products for household appliances with higher requirements are particularly obvious. Therefore, strong technical barriers are formed for material research and development capabilities, equipment operation levels, process improvement and innovation, and quality testing and evaluation.

Company Profiles

Company Profiles Company Culture

Company Culture Message

Message Honor

Honor Video Center

Video Center Company Reality

Company Reality Pearl River Cable

Pearl River Cable Low Voltage Cable

Low Voltage Cable Medium Voltage

Medium Voltage Mineral Cable

Mineral Cable Control Signal Cable

Control Signal Cable Corporate News

Corporate News Cable Information

Cable Information Media Reports

Media Reports Network Reprint

Network Reprint